introduction

medical insurance fraud is a serious problem for countries around the world.1,2 medical insurance funds around the world lose approximately $260 billion annually due to medical insurance fraud, equivalent to 6% of global health spending.3 countries have attached great importance to the construction of medical insurance anti-fraud tools, among which the reporting of medical insurance fraud by people has become an important tool of great interest because it helps to detect medical insurance fraud early,4–6 and federal regulators in the united states value the information provided by whistleblowers on medical insurance fraud, and almost half of the fraud losses recovered between 1996 and 2005 came from lawsuits filed by whistleblowers.6 china also places great importance on individuals reporting medical insurance fraud.7 the study of people reporting medical insurance fraud has also become an important area of interest for scholars.5,6 people’s willingness to report is an inevitable stage in promoting the occurrence of whistleblowing behavior and is the core prerequisite for behavior to occur.8,9 it is worthwhile for the medical insurance field to explore research on individuals’ willingness to report medical insurance fraud.

an individual’s willingness to report may be more related to whether he or she is a direct victim. studies in justice�related fields have shown that a victim is more inclined to report,10 while the reluctance of non-victims to report is a serious problem.11,12 therefore, we hypothesize that whether people are direct victims of medical insurance fraud may have a key impact on their willingness to report. the purpose of this study is to focus on whether there are differences in individuals’ willingness to report medical insurance fraud between two scenarios of whether medical insurance fraud results in a direct loss of benefits to the individual. and analyze how the factors that influence an individual’s willingness to report differ in the two scenarios.

so far, the main areas and hot topics of international medical insurance anti-fraud research are focused on exploring effective medical insurance fraud identification and monitoring by building multiple models,13–15 the construction of anti�fraud laws and regulations.16 while much of the above research has been done in the area of medical insurance anti-fraud. however, few studies have examined whether there are differences in individuals’ willingness to report medical insurance fraud and the factors that influence it, in terms of two scenarios of whether individuals suffer a direct loss of benefits.

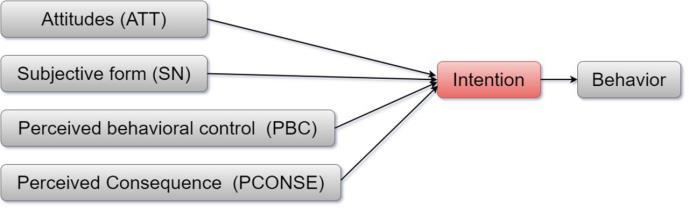

to the best of our knowledge, there are no studies at this time that specifically explore the factors influencing people’s willingness to report medical insurance fraud. this study uses the theory of planned behavior (tpb) framework to explore the factors that influence willingness to report. several studies have verified its explanatory power for behavior as well as willingness.17 tpb considers intention as the closest determinant of people’s behavior (ajzen, 1991).8 the theory suggests that the intention to perform the behavior is predicted by three factors: attitude toward the behavior (att), subjective norm (sn), and perceived behavioral control (pbc). attitude toward the behavior (att) refers to a positive or negative evaluation of a person or a behavior. subjective norm (sn) refers to the social pressure that people perceive when they decide whether or not to perform a certain behavior. perceived behavioral control (pbc) refers to the perceived ease with which an individual performs a behavior and includes the resources, time, experience, information, opportunities, and abilities that would facilitate and hinder the degree of the individual’s intended behavior (ajzen & madden, 1986).18–20 the perceived consequences variable, which considers risky decisions, will also be introduced. this variable is derived from triandis, who argues that any behavior can lead to positive or negative outcomes and that the perception of such outcomes directly affects an individual’s willingness to act.21 the specific theoretical framework is detailed in figure 1.

therefore, this study innovatively explores the differences in people’s willingness to report medical insurance fraud and the factors influencing it under two scenarios of whether medical insurance fraud causes direct harm to people’s interests. explore further what factors contribute to the willingness to report. it can provide insight into the psychology of individuals facing wrongdoings from a microscopic perspective, and provide a reference for government departments when formulating relevant reporting policies.

figure 1 extending the theory of planned behavior

conclusion

in summary, the willingness of individuals to report medical insurance fraud and the factors influencing it differed significantly between the two scenarios of whether medical insurance fraud resulted in a direct loss of personal benefit. first, perceived behavioral control was the most significant difference between the two scenarios, and this dimension only had an effect when medical insurance fraud did not result in a direct loss of personal benefit. second, in the perceived consequences dimension, fear for one’s own safety after choosing to report medical insurance fraud is inversely related to the willingness to report when medical insurance fraud causes a direct personal benefit loss scenario. the more satisfied the government is with the security measures taken to protect whistleblowers, the stronger the willingness to report when medical insurance fraud does not cause direct personal benefit loss scenarios. furthermore, the influencing factors of the attitude dimension are the same in both scenarios, and the more supportive the attitude toward the whistleblower, the stronger the individual’s willingness to report will be. finally, subjective norms are one of the effective factors influencing the willingness to report medical insurance fraud. however, there are shortcomings in our analysis. first, cross-sectional studies provide useful information but cannot elucidate causal relationships. future studies will further investigate temporal order through a longitudinal design to explain causal relationships. second, although it is reasonable and theoretically intuitive to explore the willingness to report under two scenarios of whether an individual suffers a loss of benefits. but the potential mechanism of action is not yet well understood. however, our study can be taken as a starting point, inspiring more contextually relevant hypotheses for future research.